-40%

Garan > Garanimals Berkshire Hathaway stock certificate

$ 26.39

- Description

- Size Guide

Description

Old Stock Yard Collectible Stock and Bond CertificatesGaran, Incorporated

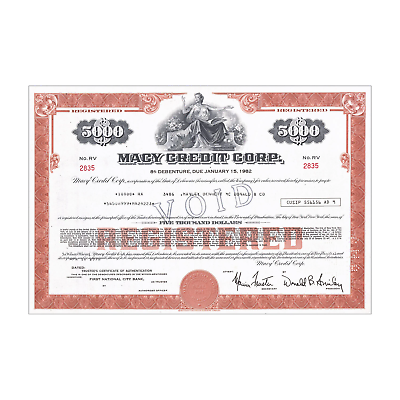

Original stock certificate

1968 - New York (Incorporated in Virginia)

Garan manufactured children's clothing under the Garanimals brand. The company was bought out by Warren Buffet's Berkshire Hathaway in 2002. Read more about the company below.

More information about Garan

:

Key Dates:

1957:

Garan is incorporated as a merger of seven companies.

1961:

The company goes public.

1972:

Branded children's apparel is introduced under the Garanimals label.

1975:

A licensing division is established to distribute clothing bearing the designs of professional sports teams.

1991:

Garan becomes one of the few apparel companies allowed to use characters from Disney movies on its products.

2002:

Garan is acquired by Berkshire Hathaway Inc.

Company History:

Garan, Inc., is engaged in the design, manufacture, and sale of men's, women's, and children's apparel under the Garanimals, Garan, Bobbie Brooks, and private label names. Most of Garan's output is sold to mass merchandisers, major national chain stores, department stores, and specialty stores. Wal-Mart Stores Inc. accounts for over 85 percent of company sales, while nearly 10 percent of sales stem from the company's relationship with JC Penney Company Inc. Garan was acquired by Warren Buffet's Berkshire Hathaway Inc. in 2002.

Eight Years of Growing Profits: 1957-65

Garan was incorporated in 1957 as a merger of seven companies, the first of which was incorporated in New York in 1941 as Myrna Knitwear, Inc. Its name originated from management coining "Guarantee" as the name for a new T-shirt but instead deciding to use the first part of the word as the corporate title. Company headquarters were located in Manhattan's garment district. Sales rose to .1 million in fiscal 1960 (the year ended September 30, 1960) from .2 million in 1957, when net income was only ,000.

By 1961, the year the company went public, Garan was the nation's leading manufacturer of men's and boys' knitted sport shirts. It also made men's and boys' woven sports shirts, polo shirts, and boys' knitted pajamas. Knitted products were being made from cotton, acrylics, polyester and cotton blends, and textralized nylon yarn. Woven products were being made from cotton and rayon and from cotton, acetate, and polyester blends. The materials were being purchased from a number of textile manufacturers.

More than 90 percent of Garan's sales volume of .8 million in 1961 came from its sports shirts, which retailed for between .95 and .95. About two-thirds of its output was being sold under private labels, with the remainder selling under the Garan name. Accounts included Macy's, JC Penney, Woolworth's, and Sears, Roebuck. A new plant in Lambert, Mississippi, began manufacturing higher-priced Ban-Lon shirts from Garan's own knitted fabric in 1961, and another factory, in Clinton, Kentucky, also began operations that year.

Garan's first public offering, at .50 per share on the American Stock Exchange, raised 0,000 for the company and enabled it to finance its own receivables without factoring (hiring someone else to collect its bills). Almost two-thirds of the shares, the value of which rose as high as nearly per share in 1961, remained in the hands of the officers and directors of the company, headed by the president and chairman of the board, Samuel Dorsky, and the executive vice-president and secretary, Seymour Lichtenstein, who soon advanced to president. The company's property in 1962 consisted of six leased factories in Kentucky, Mississippi, Pennsylvania, and Tennessee, and a warehouse in Tennessee. Net sales rose to million that year, and net income increased to 4,703 from the previous fiscal year's 8,894. The company then declared a dividend for the first time.

Sales and net income for 1963 reached new levels of .1 million and 7,000, respectively. A 76,000-square-foot facility for the production of woven sports shirts opened in Kosciusko, Mississippi, in 1963, replacing two smaller units, and the company began selling Acrilon (as well as Ban-Lon) shirts for boys under its own Rhodes label. The following year, Garan opened another 76,000-square-foot plant for knitted garments in Starksville, Mississippi, and a 35,000-square-foot factory for woven sports shirts in Carthage, Mississippi. The Lambert facility was doubled in size. Plans were begun to devote part of the existing Adamsville, Tennessee, facility to popular-priced, man-tailored women's blouses.

In 1965, a new factory opened in Philadelphia, Mississippi, for the manufacture of boys' jeans and slacks. Garan's net sales reached nearly million that year, and its net profit increased for the eighth year in a row. Long-term debt was only .9 million. All nine of the company's plants were situated in the South. JC Penney and Sears were taking about two-thirds of total production. The company's Rhodes label, sold through department stores, was being promoted only modestly, and its own Garan label, directed at discounters and chain stores, required minimal advertising.

The going got rougher for Garan in the next few years. Profits fell for the first time in 1966 because of inventory write-offs in velour, high in-house costs for a computer system subsequently phased out, and the costs of decentralizing companywide operations to a divisional basis. Net income passed the million mark in 1967, and doubled in 1968, but fell to 0,000 in 1969 as the company's Ban-Lon sweaters and shirts met with increased competition. In 1970, sales fell from .1 million to .8 million, although net income rose slightly.

A Wider Mix of Products in the 1970s

By 1972, Garan was back in stride, having topped million in net income the previous year. Heightened productivity, tighter cost controls, fewer markdowns, and a wider mix of products were credited for the company's turnaround. Of its eleven factories, seven were located in Mississippi and one each was located in California, Kentucky, Louisiana, and Tennessee. The company started making men's pants in 1969, jeans for girls in 1971, and children's apparel in 1972. It also introduced a "Jugs" line of pants and knit shirts for girls 15 years and older. Shirts now represented only 46 percent of Garan's varied production. Roughly three-quarters of its merchandise bore the labels of its customers, and the balance was being sold under the Garan label.

By the mid-1970s, Garan was a broad-based producer of knitted and woven apparel for girls, infants, and men as well as boys. Branded children's apparel was introduced in 1972 under the Garanimals label, a system of coordinating tops and bottoms with color-keyed mix-and-match animal tags and hangers. Two years later, the company opened a new plant devoted exclusively to turning out knitted tops and woven bottoms for infants and toddlers. Garan also restored men's knit sport shirts as a meaningful part of its apparel mix. A licensing division established in 1975 began distributing sweatshirts, sweaters, knit shirts, and T-shirts bearing designs of professional sports leagues and teams.

There were 23 Garan plants at the end of 1977, a year in which net sales reached 2.8 million and net income rose to .7 million, both records. The Garanimals label accounted for 30 percent of sales volume. Sears and JC Penney remained the largest of Garan's more than 2,000 accounts. Long-term debt was only .9 million. About 44 percent of the company's shares of common stock was closely held.

Garan averaged an excellent annual return on equity of more than 17 percent between 1979 and 1983. During this period, it added the Garan Mountain Lion brand name, which along with Garanimals accounted for more than half of company sales in 1983 and also enjoyed higher profit margins than the firm's private labels. Licensed sweatshirts and T-shirts continued to be marketed through mass merchandisers, department stores, and other customers. Sales of children's clothing represented about 70 percent of the 1983 sales total. Branded and licensed apparel accounted for about two-thirds of sales, and private label and licensed business to Sears and JC Penney accounted for the rest.

Garan Advantage, a line of discounted men's sportswear with the same tagging system as Garanimals, was introduced in 1982. Garan Man, a sportswear line of knit and woven shirts, casual slacks, and pullover and cardigan sweaters, was unveiled the following year. Also in 1983, the company introduced Garan By Marita for women. Garan net sales reached a record 6.9 million in 1984, and net income rose to a record .8 million. At the end of 1985, there were 20 company plants distributed throughout seven states: Alabama, Arkansas, Kentucky, Louisiana, Mississippi, Oklahoma, and Tennessee. A manufacturing facility was established in Costa Rica in 1984, and two facilities were opened in El Salvador during fiscal 1985. Long-term debt that year came to .9 million. By the mid-1980s, Seymour Lichtenstein had succeeded Dorsky, who remained a director, as chairman and chief executive officer, and Jerald Kamiel had succeeded Lichtenstein as president and chief operating officer.

Fiscal 1985 began a tailspin for Garan: sales fell to 5 million in 1986 and earnings dropped to a low of .2 million the following year. A number of factors were blamed, including cheap imports, the demise of the preppy look, and the miniskirt disasters. The company cut back on branded products, which accounted for only 47 percent of sales in 1988, compared with 75 percent in 1986. It introduced Bobbie Brooks, an in-house label for Wal-Mart Stores' women's clothing, and began a licensed menswear line featuring the insignia of professional sports teams. Company plants were retooled for lower costs and greater efficiency. Sales and profits improved, reaching 5.3 million and nearly million, respectively, in 1990.

Relying on Wal-Mart in the 1990s

By 1992, burgeoning Wal-Mart was accounting for 45 percent of Garan's annual sales. A licensing agreement in 1990 gave Garan the right to carry the insignias of various colleges and universities on sweatshirts and knit shirts. In 1991, it became one of the few apparel companies allowed to use characters from Disney movies. After a strong first quarter in fiscal 1992, Garan, holding million in cash with virtually no debt, declared a .20-per-share annual dividend on top of the quarterly payout. During 1988-92, the company earned an annual average of almost 18 percent on equity.

Net sales came to a record 9.6 million in 1993, when net income totaled .8 million. The following year was not as good, with sales of 3 million and income of .4 million. For fiscal 1995, results were even more disappointing: only 3.3 million in sales and .5 million in income. The company's market value, once nearly 0 million, dipped to less than million. Some analysts blamed the company's heavy dependence on Wal-Mart (accounting for 63 percent of sales during fiscal 1995). Oversaturation in licensing, rising raw material costs, and cut-throat pricing were also cited as reasons for the firm's poor performance. During 1995, Garan became the exclusive licensee of the Everlast trademark for men's, boys', and girls' activewear, and of the trademark Hang Ten for boys' sportswear.

During fiscal 1995, children's apparel accounted for 72 percent of Garan's net sales, with women's apparel accounting for 18 percent and men's apparel accounting for 10 percent. Sales of sports and colleges licensed apparel accounted for about 12 percent of sales and Garan's own label accounted for about 6 percent. The Bobbie Brooks label accounted for another 7 percent, and Disney characters, scenes, and logos accounted for about 8 percent. In addition to Wal-Mart, JC Penney was an important customer that provided 20 percent of Garan's sales. Some 3,500 or so clients took the rest of the company's output.

Garan maintained 18 manufacturing plants in 1995 in the following locations: Haleyville, Jemison, and Rainesville, Alabama; Ozark, Arkansas; Clinton, Kentucky; Church Point, Kaplan, and Marksville, Louisiana; Carthage, Corinth, Eupora, Lambert, Philadelphia, and Starksville, Mississippi; Adamsville, Tennessee; San Jose, Costa Rica; and two in San Salvador, El Salvador. All were leased in whole or in part except for the plants in Clinton, Haleyville, and San Jose. The company was also leasing its headquarters and showroom in New York City's Empire State Building. Seymour Lichtenstein owned 12 percent of Garan in 1995 and heirs of Samuel Drosky owned another 12 percent. Other officers and directors owned 16 percent. The long-term debt was .2 million in March 1995. Dividends had been paid every year since 1962.

Changes in the Late 1990s and Beyond

Competition remained fierce in the apparel industry well into the late 1990s and beyond. Garan continued to rely heavily on its relationship with Wal-Mart and its other large customers to shore up sales and profits. In 1998,

Apparel Industry Magazine

named Garan as one of the top eight most successful apparel manufacturers in the industry based on profits, a sure sign that management's efforts were paying off. Indeed, the company forged ahead creating a strategy focused on remaining competitive in the early years of the 21st century. Sales in 2001 reached 7 million, an increase of 8.9 percent over the previous year. Net earnings rose as well, climbing from million in 2000 to .6 million in 2001. The company decided to phase out its professional sports team and college and university licensed activewear that year.

During this time, Garan management began laying the groundwork for a major change that would secure a financially sound future for the company. In 2002, the firm struck a deal with Warren Buffett, chairman of Berkshire Hathaway Inc. Known for his business savvy, Buffett had amassed billions over the years by acquiring shares of various companies. "Because he controls, through his company Berkshire Hathaway, one of the most liquid sources of capital on earth, Buffett has recently been able to step up and buy huge chunks of American businesses, especially in the hard-hit sectors like telecom, utilities, and energy," reported a November 2002

Fortune

magazine article.

Berkshire Hathaway's holdings were diverse, proof that Buffett's interests ran across the board. The aforementioned article described the company, stating, "It is a conglomerate with sizable operations in insurance. It holds large stakes in giant American companies such as Coke, Gillette, and American Express. Berkshire also controls a significant utility and gas pipeline business, and it owns an amazing cornucopia of mundane operations--things like furniture retailers, jewelry shops, and shoe factories." As such, industry observers were not shocked Berkshire Hathaway announced its acquisition of Garan in the summer of 2002.

Buffett made a per share cash offer for the firm, believing it would fit nicely into Berkshire Hathaway's apparel division along with Fruit of the Loom Co., the underwear manufacturer purchased earlier in the year. Garan management agreed, and the acquisition was completed in September. The company remained intact with headquarters in New York. Seymour Lichtenstein remained at the helm, confident Garan would succeed in the years to come as a Berkshire Hathaway subsidiary. - Company information sourced from FundingUniverse.com

Old Stock Yard Policies and FAQs

Please visit my eBay store

– any combined certificate purchased

ship free

with auction items!

Shipping and Handling Charges:

.99 for one certificate to the U.S.

.99 for one certificate to the rest of the world

Additional, combined certificate purchases

ship for free

!

Shipping Method and Timing:

Certificates are carefully packaged in poly bags and rigid envelopes to protect them during shipment. Items are sent via U.S.P.S. – usually first class, but occasionally priority or parcel post. Most items will be mailed within 48 hours of payment.

Payment Method:

In accordance with

eBay

policy, my listings are setup to accept

PayPal

payments. Sellers are allowed to accept other forms of payment only if the buyer requests another payment method – so if you prefer to pay using a method other than PayPal, please let me know.

Return Policy:

Items can be returned for any reason within 15 days of purchase. A full refund will be issued upon receipt of the return if the item is the same condition it was in upon delivery.

FAQs:

Are you your certificates authentic or copies?

Everything

I sell is original and authentic. I do not sell copies or reproductions.

Is the certificate pictured the exact one I will receive?

Usually, yes. Occasionally, I do list certificates of the same type without rescanning. In this case, the certificate you receive will be virtually identical (same color, size, vignette, etc.) to the one pictured. Again, if you ever receive anything from me you are not 100% pleased with, you can return it for a full refund.

What is the best way to store, protect, and display my certificate collection?

The best thing, by far, that I have come across for storing certificates are

profolios and sleeves made by Itoya

. You can purchase them in my eBay store. I have several sizes available.

Do the certificates you sell have financial value?

No, these certificates are sold as collectibles only; although they are authentic, they no longer hold financial value.